Looking for help?

Tax Systems In Teesom

There are 2 tax systems available to select in Teesom, Sales tax on order and Sales tax per line on order. In this article we will show how to choose your tax system as well as show how both tax systems look in Teesom to illustrate the differences between the two.

Choose Your Tax System

To select which tax system your company will use go to the “Company Setup” screen:

- Click on “Setup“

- Expand “My Company“

Scroll down, below “Company Addresses” and select the “Tax System” for your company:

Sales Tax On Order

This is the primary system used in the United States. The tax percentage is set for the whole order, and then each row on the order is set to either ‘Taxable’ or ‘Non-taxable’.

Company Setup

Under Company Setup -> Lists you will see 2 sections:

- Sales Tax

- Item Tax

Under “Sales Tax” you can create a number of different tax codes with different rates, as well as combined taxes. Sales Tax is set for the entire order.

Under “Item Tax” there will usually be only 2 codes, ie: “TAX” and “NON” – and you can then set your items and products to either one of these. Item Tax is set for each individual line/row on an order.

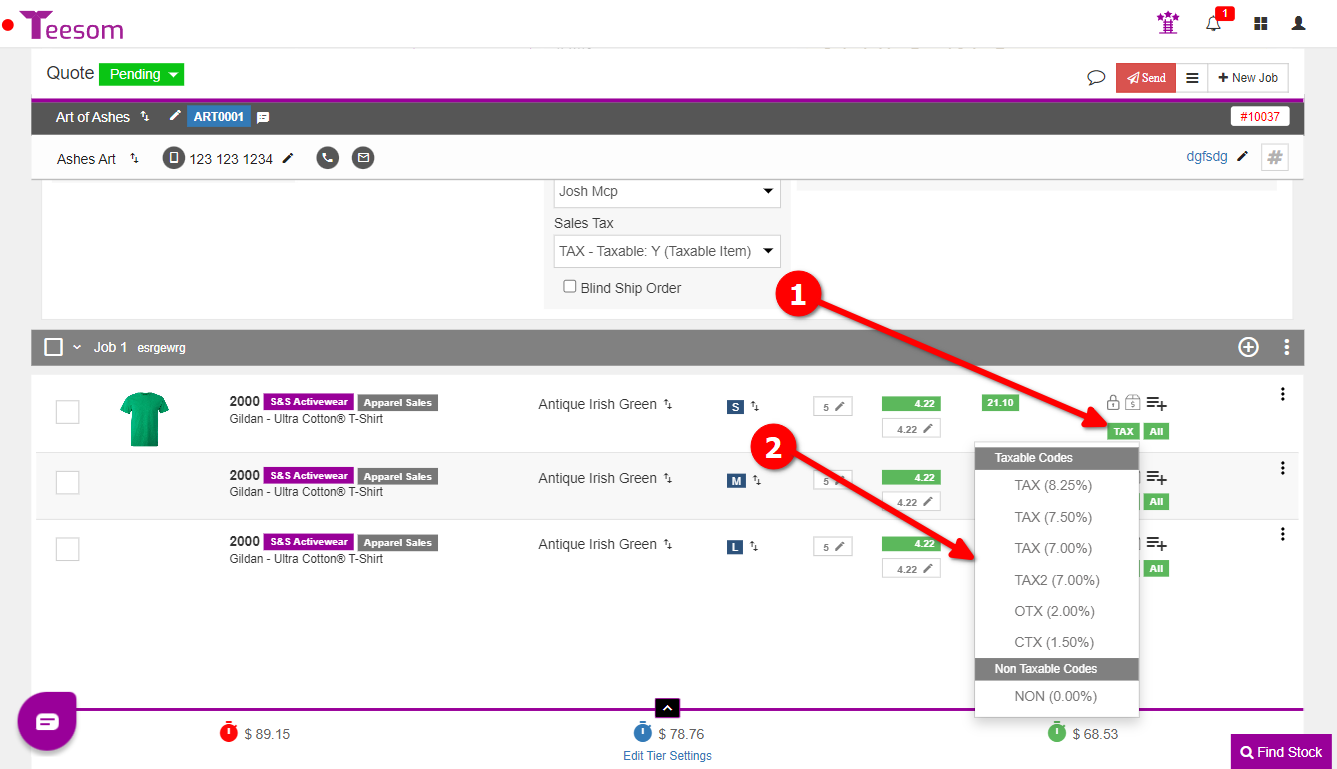

How It Looks On An Order

With “Sales Tax On Order” set as your company’s tax system, when you create orders the whole order will be taxed the same, and you will select whether the product rows are taxable or not:

- The “Sales Tax” the order is using. Click to select a different tax rate. (To change this on a WIP invoice you must be in edit mode.)

- This is a taxable row.

- This is a non-taxable row.

You can set whether or not a product row is taxable. To change this on a WIP invoice you must be in edit mode. To do so:

- Click on the green “Tax” or the grey “Non”.

- Select either a taxable code or a non-taxable code.

Sales Tax Per Line On Order

The order itself is either set to ‘Taxable’ or ‘Non-taxable’, and then each row is individually taxed a certain rate. In other words: each row on the order could be taxed at a different rate.

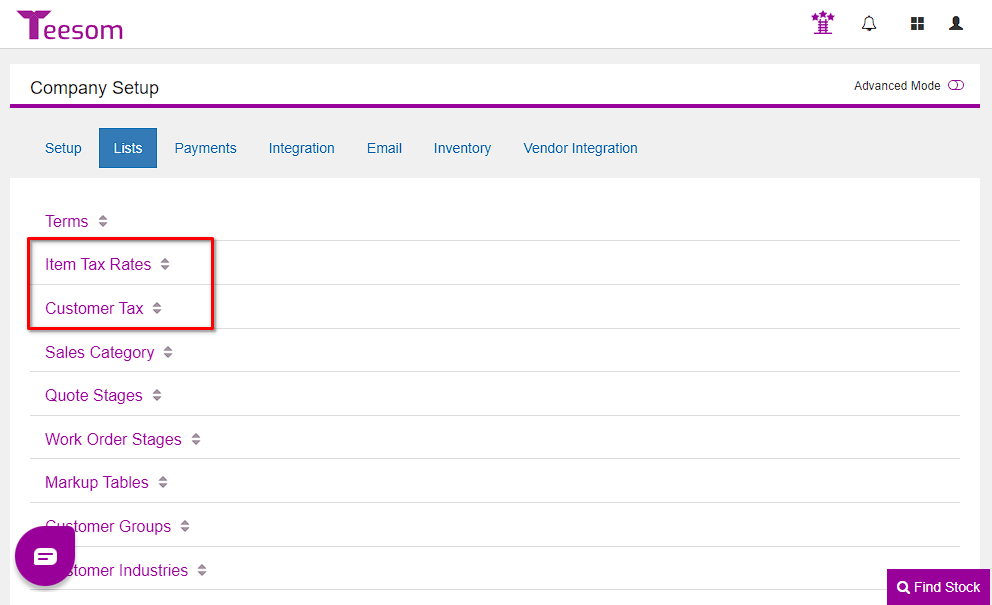

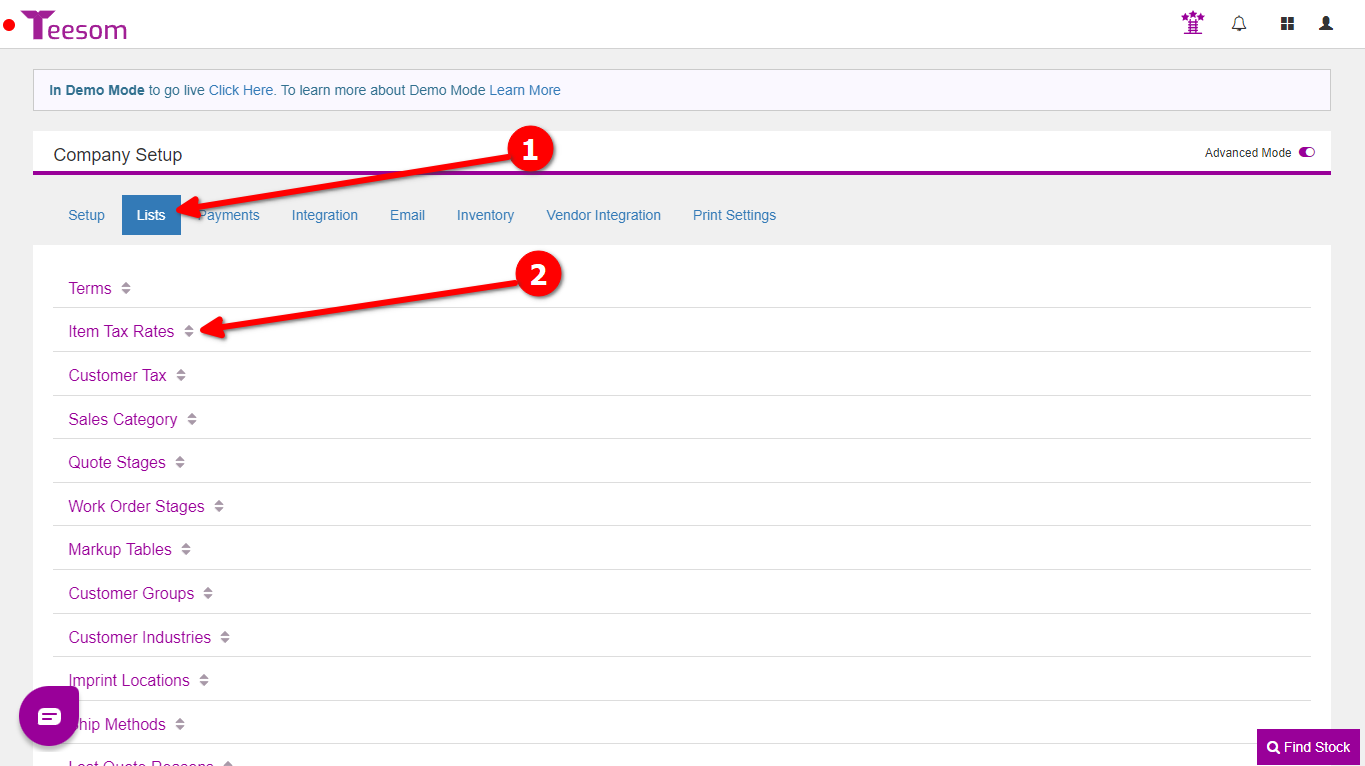

Company Setup

On the Company Setup Page, under the Lists tab you will see 2 sections:

- Item Tax Rates

- Customer Tax

Under “Item Tax Rates” you can create a number of different tax codes with different rates, as well as combined taxes. Item tax rates are set for each row/line on an order.

Under “Customer Tax” there will usually be only 2 codes, i.e: “TAX” and “NON” – and you can then set your orders to either one of these. Customer Tax is set for the entire order.

How It Looks On An Order

With “Sales Tax Per Line On Order” set as your company’s tax system, when you create orders the whole order will be set as either Taxable or Non-Taxbale, and you will select the tax rate for each product row:

You can set the tax rate for each product row. To change this on a WIP invoice you must be in edit mode. To do so:

- Click on the green “Tax” or the grey “Non”.

- Select either a taxable code or a non-taxable code.